Adam Steyr with Mortgage Solutions and it's about that time of year again where we get to talk about everybody's favorite subject: property taxes. Right, so now that you own your home (congratulations, by the way), property taxes are part of the deal. The good news is that you can reduce your property taxes by claiming the homestead exemption, which is what I want to talk to you about today. So first off, let's have a recap of what the homestead exemption is. Basically, the property taxes that we pay here in Texas are determined by how much the county appraisal districts say the land and buildings are worth. That value is then multiplied by the tax rate to determine how much your property taxes are for that year. The homestead exemption removes part of the value of your property from taxation, which lowers the amount of property taxes that you're going to have to pay. So how do we qualify for the homestead exemption? There are basically three things that we must do in order to qualify. Number one, we must own the property (easy enough). Number two, we must use it as our primary residence as of January 1st of the year in which we are applying (so January 2019 will be good). And number three, the address on our driver's license must match the address that we're claiming the homestead exemption for. Just those three things. Now, you're probably wondering how much this homestead exemption is going to save you, right? Well, Texas law requires the school district to provide a $25,000 exemption for property taxes. So, for example, let's say the county appraisal district has your house valued at $100,000. Once the homestead exemption is in place, you will pay school taxes as if your home was worth $75,000....

Award-winning PDF software

Texas blue 2025 Form: What You Should Know

The following information must be filled out on each support form: name of the client, a description of the support request and the total child support owed (payable through the parent, custodial parent, or guardian), the child's current address, and the amount of support owed on each form (the amount is the “actual annual” amount paid, not the number of months the support should remain paid). Forms can be completed online or by requesting a paper copy of a required Child Support Form.

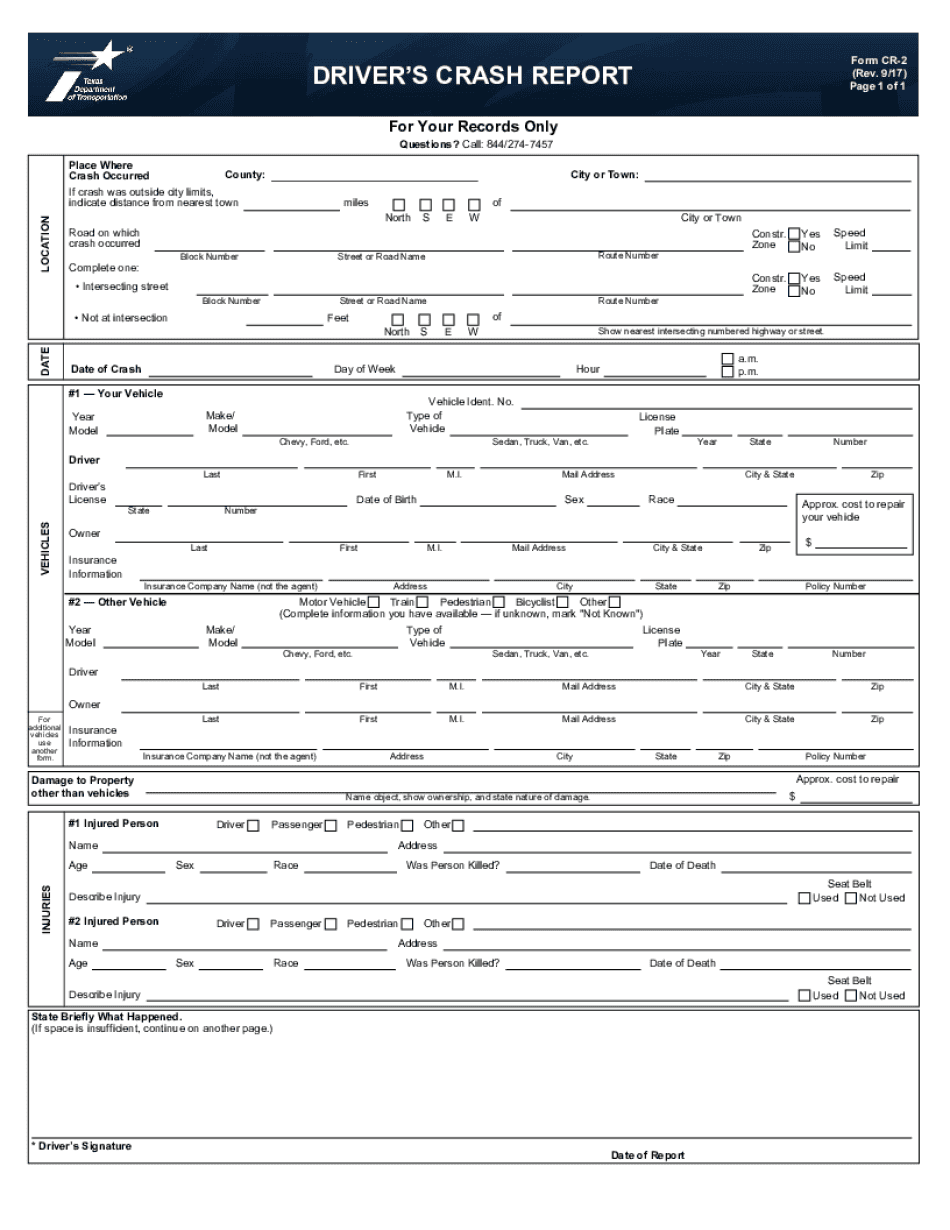

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do TX CR-2, steer clear of blunders along with furnish it in a timely manner:

How to complete any TX CR-2 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your TX CR-2 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your TX CR-2 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Texas blue form 2025